35+ conventional mortgage requirements

A debt-to-income ratio under 43 potentially lower if you dont have great credit A minimum credit score of about 620 A down payment of at least 3 20 if you want to avoid paying for mortgage insurance. The funds can come from a gift or your own money.

Best Home Loans Mortgage Lenders Company Arizona Utah

Web Conventional Loan Requirements Down Payment.

. Should not exceed 43 Ideally borrowers should aim for 36 If you have student loans you may still qualify up to 50. Web Mortgage lenders generally require a debt-to-income ratio DTI thats below 36 for conventional loans though in some cases a lender may accept a higher DTI. Conventional mortgages are available as fixed-rate or adjustable rate mortgages.

Conventional loans with less than 20 down require private mortgage insurance PMI to protect lenders if you default. Web A Communitys Eligibility for a Conventional Loan A credit score of at least 620 is usually required to qualify for a conventional loan. For a jumbo loan youll typically need a DTI of 45 or lower and most lenders consider this a hard cap.

An institution that for a fee provides historical credit records of individuals provided to them by creditors subscribing to their services. These incorporate a 620 FICO rating an obligation to-pay proportion lower than 43 and in any event a 3 initial installment. If you earn 5000 per month before taxes for example then your monthly debt payments should take up less than 2500 of your income.

Web These include. Web Current minimum mortgage requirements for conventional loans Down payment. Web The conventional loan requirements fluctuate on the basis of who is providing the loan.

Web Requirements for an FHA mortgage tend to be less restrictive overall and critical requirements for these types of loans include a lower credit score eg above 500 a debt-to-income ratio of 50 or less and a down payment requirement that will vary based on credit score. If you have less than 20 for a down payment youll likely have to pay private mortgage insurance PMI with a conventional loan. Web With a conventional loan borrowers have a choice of 15 20 25 or 30-year mortgage terms.

Web If a conventional loan exceeds FHFA loan limits or uses underwriting standards that are different from those set by Fannie Mae and Freddie Mac its called a nonconforming loan. Conventional Loan Requirements generally follow mortgage guidelines administered by government-sponsored. A minimum credit score of 620 A debt-to-income ratiolower than 43 can be higher depending on qualifying factors A down payment of at least a 3.

Front end DTI Should have a maximum of 28. Show i By 15 or more percentage points for loans secured by a first lien with a principal obligation at consummation that does not exceed the limit in effect as of the date the transactions interest rate is set for the maximum principal obligation eligible for purchase by Freddie Mac. Web While you can get a conventional mortgage with as little as 3 down some lenders may prefer you to have at least 10 to put toward a down payment.

Conventional loans have a higher minimum credit score requirement than government-backed loans. Usually they do this by. Web Standard qualification requirements include.

45-50 of gross monthly income Conforming loan limits. Credit score 700 is ideal lenders typically accept around 680. Its possible for first-time home buyers to get a conventional mortgage with a down payment as low as 3.

Rates Comes in fixed and adjustable-rate mortgage ARM. Web Conventional mortgage requirements allow for a maximum DTI ratio of 50. Web Official interpretation of Paragraph 35 a 1.

Conventional loans require a higher down payment than. Web To qualify for most conventional loans youll need a DTI below 50. Web A Conventional Loan is a residential mortgage loan that is not insured or guaranteed by the federal government.

Web At a glance. Your lender may accept a DTI as high as 65 if youre making a large down payment you have a high credit score or have a large cash reserve. Youll need at least a 3 down payment for a conventional loan.

Qualifications for a conventional loan Min. In real estate mortgage financing that is not insured or guaranteed by a government agency such as HUDFHA VA or the Rural Housing Service. Web Requirements Conforming Conventional Mortgages.

Be that as it may all conventional mortgages need to meet certain rules set by Fannie Mae and Freddie Mac. Web One of the main requirements for a conventional loan is that the home must be appraised. If you put down less than 20 on a conventional loan youll be required to pay for private.

Check If You Are Eligible. 620 for fixed-rate and 640 for adjustable Debt-to-income ratio. The appraisers job is to work out the propertys actual market value.

Usually 5 or 3 for some first-time and low-income buyers Min. Your DTI represents the total. Borrowers with credit scores of 740 or above can make smaller down payments and access the best conventional loan rates.

Current Fha Home Loan Rates Fha Mortgage Rates

Critical Defect Rates Rose 6 In Q2 2022 Per Aces Quality Management Mortgage Qc Industry Trends Report Send2press Newswire

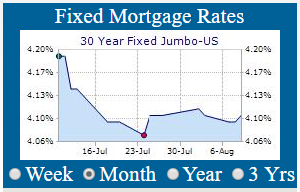

Current Fixed Mortgages Rates 30 Year Fixed Mortgage Rates

25 Best Loan Service Near Corona California Facebook Last Updated Feb 2023

25 Best Mortgage Brokers Near Blue Springs Missouri Facebook Last Updated Jan 2023

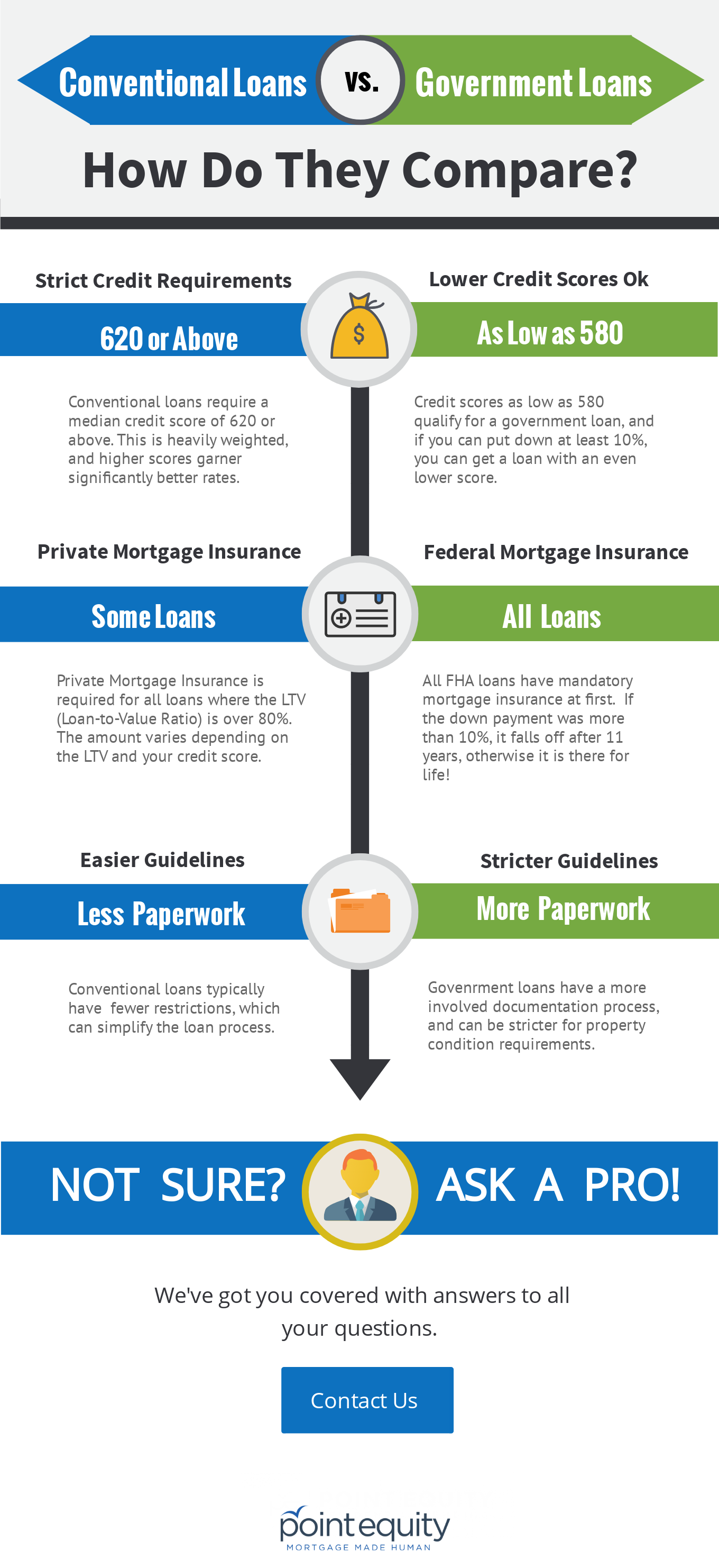

Top 3 Differences Between Conventional Government Loans

Top Mortgage Loans In Ramanagara Best Property Loans Justdial

Pipeline Magazine Summer 2019 By Acuma Issuu

81 Of Canadians Are Worried About A Recession In 2023 Survey Ratesdotca

V I P Mortgage Inc Linkedin

Conventional Loan Requirements Moneygeek Com

For Sale Rush Co 80864 Unreal Estate

Meridian Credit Union A Quick Take Mortgage Rates Mortgage Broker News In Canada

Fha 203k Loan Renovation Mortgage Loans Explained

Defy Mortgage Linkedin

Conventional Loan Guidelines Mortgage Specialists

Realloans Com Facebook